unemployment tax credit irs

A favorable determination letter is issued by the IRS when an organization meets the requirements for tax-exempt status under the Code section the organization. 990-EZ 990-PF or 990-T returns filed with the IRS by charities and non-profits.

Unemployment Compensation Are Unemployment Benefits Taxable Marca

100 free federal filing for everyone.

. Congress hasnt passed a law offering. The legislation allows taxpayers who earned less than 150000 in adjusted. The taxpayer had not included the payment in income following Notice 2014-7 but did include the amount as earned income in computing an earned income credit under IRC 32 and in computing the refundable child tax credit under IRC 24.

The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of unemployment compensation paid in 2020. We provide guidance at critical junctures in your personal and professional life.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. On March 11 2021 President Biden signed into law the American Rescue Plan Act. Sorry I have my transcript in my hand.

Payments begin July 15 and will be sent monthly through December 15 without any further action required. In January of 2021 a record high number of taxpayers will receive a Form 1099-G Certain Government Payments indicating the amount of unemployment compensation UC paid to them during 2020 that must be reported on their 2020 federal income tax return. Irs Child Tax Credit Payments Start July 15 Tax Year 2019 Form 990EZ.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. The IRS argued that since the amount was not taxable under Notice 2014-7 it did not count as earned. The IRS will start issuing refunds to eligible.

IRS tax deadline. Ad File your unemployment tax return free. Premium federal filing is 100 free with no upgrades for premium taxes.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Learn More At AARP. 2020 has been a difficult year particularly for those experiencing unemploymentTaxpayers who received UC.

In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse. Ad Tax Strategies that move you closer to your financial goals and objectives. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March.

Single 1 exemption AGI 19600 Taxable Income 6943 Tax per Return 888 SE Taxable Income 1277 Total SE. To qualify for this exclusion your tax year 2020 adjusted gross. The American Rescue Plan which President Joe Biden signed in mid-March waived federal tax on up to 10200 of unemployment benefits per person.

September 13 2021. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. Retirement and health contributions extended to May 17 but estimated payments still due April 15.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only.

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Unemployment Refunds Moneyunder30

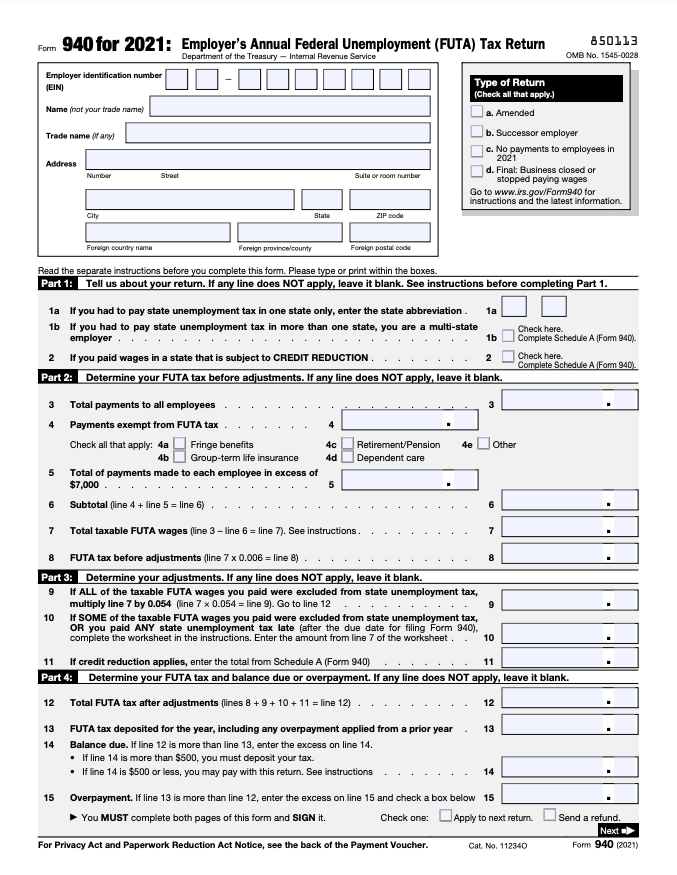

Form 940 When And How To File Your Futa Tax Return Bench Accounting

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

When Will Irs Send Unemployment Tax Refunds 11alive Com

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

Confused About Unemployment Tax Refund Question In Comments R Irs

Interesting Update On The Unemployment Refund R Irs

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Usa

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor